Allied health group Advent Health is preparing to join the ranks of the ASX by way of a reverse takeover next month with a plan to improve efficiencies and boost profitability of its founding practices.

The move entails shell company Millennium Limited (ASX: MHD) acquiring all of the shares in the multi-disciplinary healthcare business and relisting on the ASX under the ‘Advent Health’ name and ticker code ‘AH1’.

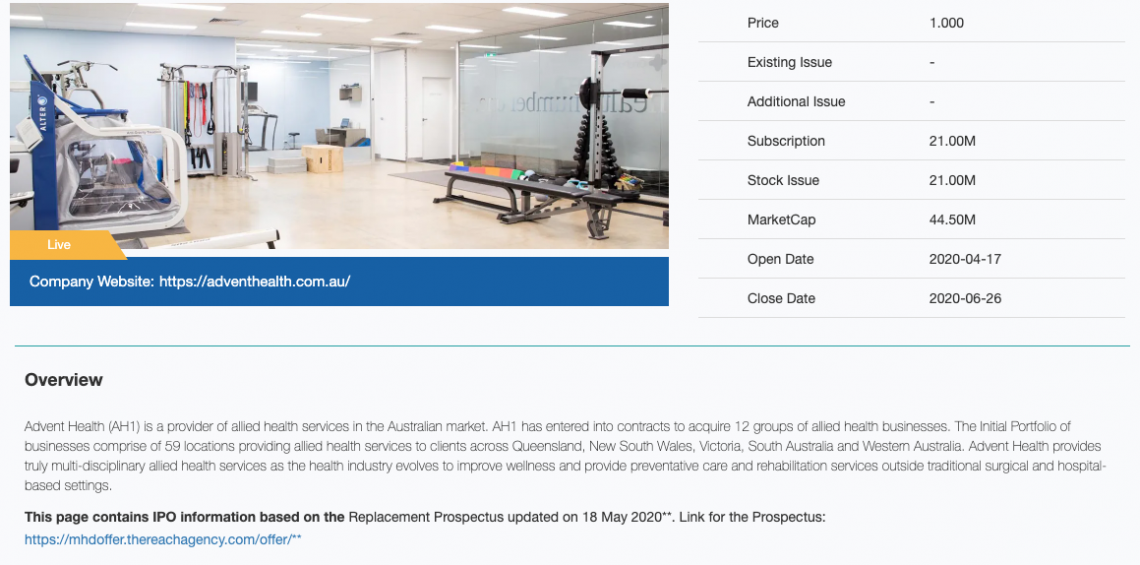

The proposed company will be made up of a consolidated group of 300 clinicians in 12 allied health practice groups with 59 locations across most states of Australia.

Through its initial public offering, the company is offering 21 million shares at $1 each to raise $21 million, indicating a market capitalisation of $44.5 million upon completion.

Speaking with Small Caps, Advent chief executive officer Cris Massis said entering the ASX via a reverse takeover means the company is able to move quickly and give its vendors some certainty of listing.

He added that unlike other roll-up strategies, Advent has done a lot of its integration work already.

“In a roll-up, everything is integrated after. We’ve done a lot of pre-work around systems, financials, technology and a whole range of procurement opportunities were done in our due diligence process,” Mr Massis said.

“We have the ability to turnkey quickly and make revenue from day one,” he added.

The offer is open now and closes on 26 June. Advent expects to be readmitted to the ASX and recommence trading on 16 July under its new name and code.